|

BLUE BONDS

ABOUT - CLIMATE CHANGE A-Z - CONTACTS - DONATE - FOUNDATION - HOME - OCEAN PLASTICS A-Z Please use our A-Z INDEX to navigate this site

|

|||||||||||||||||||||||||||||||||||

WASHINGTON

MAY 18 2018 – The United Nations and the World Bank Group today signed a Strategic Partnership Framework (SPF), which consolidates their joint commitment to cooperate in helping countries implement the 2030 Agenda for

Sustainable

Development.

There are a number of organizations that exist to promote world peace and societal projects for the good of mankind. These include the United Nations, the World Bank, the International Monetary Fund (IMF) and many smaller concerns that grant aid suitable projects. In addition there are incentives by most countries to promote clean energy and blue growth.

Climate change threatens oceans via acid rains and changing ocean chemistry, where a blue growth solution favours zero carbon shipping being implemented almost immediately to cover lost ground quickly where former complacency is now replaced with urgency in climate terms.

PACIFIC BLUE SHIPPING PARTNERSHIP - Several Pacific islands have formed a coalition to push zero carbon shipping forward at a faster pace than the IMO are working towards. Obviously, it is in all our interests to attain zero emissions from our ocean transport as quickly as possible. Full marks then to this Partnership for moving so positively.

WHAT IS A BLUE BOND ?

A Blue Bond is a debt instrument issued by governments, development banks or others to raise capital from impact investors to finance marine and ocean-based projects that have positive environmental, economic and climate benefits. The blue bond is inspired by the green bond concept, which people are more familiar with.

GREAT INFOGRAPHIC - But nothing about the Blue Economy on the World Bank website. We are concerned about Fisheries, Waste Management, Climate Change and Maritime Transport.

SOVEREIGN BLUE ISSUANCE - SEYCHELLES OCTOBER 28 2018 (EXAMPLE)

Why did Seychelles decide to issue a Blue Bond?

As the economy grew and fisheries became more exploited, the Seychelles recognized the need to rebuild and sustainably utilized fish stocks through improved governance and management of the sector. However, the costs of transitioning to sustainable fisheries can be substantial for a small island state, both in terms of management costs and the socio-economic losses as fish stocks are recovering. The potential for a sovereign blue bond to finance this transition was first identified during discussions between Seychelles, the Prince of Wales’ Charities International Sustainability Unit and the World Bank. Seychelles was keen to explore innovative financial instruments for its development agenda, particularly since its graduation to a high-income country, which limits its access to grants and donor aid.

What is the structure of the Seychelles sovereign blue bond?

The sovereign blue bond was issued with a ceiling value of US$15 million, with a maturity of 10 years. The blue bond, as well as the program of marine and ocean-related activities it will support, was prepared with assistance from the World Bank and the Global Environment Facility. This support includes a partial World Bank guarantee ($5 million) and a concessional loan from the Global Environment Facility ($5 million), which will partially subsidize payment of the bond coupons. These credit enhancement instruments allowed for a reduction of the price of the bond by partially derisking the investment of the impact investors, but also by reducing the effective interest rate for Seychelles by subsidizing the coupons.

Who invested in the blue bond?

Since the total amount of the blue bond is of relatively low volume in market terms, it was privately placed with three socially responsible impact investors based in the United States, namely Calvert Impact Capital, Nuveen, and Prudential. The placement agent is Standard Chartered Bank and the trustee is the Bank of New York.

How will the blue bond proceeds be used?

How will this project specifically benefit the Seychelles?

The main beneficiaries are Seychellois whose livelihoods depend on marine resources and the ocean. This includes artisanal and semi-industrial fishers, operators in tourism and seafood value chains, including aquaculture; national and local institutions engaged in the management of marine resources, including fishers’ associations and government entities. Ultimately, the general population will benefit from a healthier marine environment and increased food security.

Will the blue bond have an impact on Seychelles' overall debt portfolio?

This new financing is small compared to the current debt portfolio of the country and the impact of the blue bond placement on the sustainability of the debt of Seychelles is not material. The blue bond is a general obligation of Seychelles and its repayment is not dependent on any obligations created through the use of the proceeds.

How will this project contribute towards climate change adaptation?

The project will strengthen Seychelles’ resilience to the impacts of climate change. This will be made possible with the expansion of the marine protected areas network to 30% of their EEZ and the promotion of sustainable fisheries through proper control and management as the project’s ecosystem-based adaptation approach. The project complements the debt-for-nature swap that Seychelles did in 2015 with The Nature Conservancy in exchange for greater ocean protection and climate change adaptation. This project will also help Seychelles to diversify its economy and reduce its vulnerability to climate change by adopting climate-smart ocean economies. This will be through the expansion of the seafood value chains.

What role did the World Bank and the GEF play in this bond issuance?

The World Bank’s Treasury supported the Seychelles in reaching out to investors and advising on how to structure the use of proceeds from the bond.

The World Bank is also backing the Seychelles’ efforts to build a diversified blue economy via SWIOFish3, a project co-financed by the blue bond. The SWIOFish program supports countries in the South West Indian Ocean region to sustainably develop their fisheries’ sectors by improving fisheries governance, encouraging regional dialogue and cooperation and enhancing the fisheries’ value chain with better conservation, facilities, equipment and training.

What else is the World Bank doing to advance the blue economy agenda?

The development of the blue economy is fully aligned with the Bank’s support for implementing the Sustainable Development Goals, notably SDG14, and meeting our corporate twin goals in a sustainable way. Healthy oceans provide jobs and food, sustain economic growth, regulate the climate, and support the well-being of coastal communities.

The World Bank’s active Blue Economy portfolio is estimated at around $3.7 billion, with a further $1.5 billion in the pipeline. Projects range from implementing large regional fisheries programs in Africa and the Pacific, to tackling all sources of marine pollution, protecting critical marine habitats and supporting coastal development worldwide.

In August, the World Bank announced the launch of a Sustainable Development Bond series that will raise awareness on the critical role of ocean and fresh water resources.

OCEAN CLIMATE POLICY

There are as yet no definitive ocean policies concerning climate change and stages or funding instruments, though the IMO has set targets for 2030, 2040, 50% by 2050 and 100% zero carbon shipping by 2100, there is no explanation as to how to achieve that. No doubt that will be high on the United Nations Conference of the Parties in December 2019.

GLOBAL AGRICULTURE & FOOD SECURITY PROGRAM (GAFSP) - is a Financial Intermediary Fund, and the Coordination Unit is housed at the World Bank. They work in partnership with these Supervising Entities: African Development Bank (AfDB), Asian Development Bank (ADB), Food and Agriculture Organization (FAO), Inter-American Development Bank (IDB), International Fund for Agricultural Development (IFAD), World Bank, and World Food Programme (WFP). The Private Sector Window is managed by the International Finance Corporation (IFC).

....

THE PLASTIC MENACE

One of the main issues to recognise and overcome is not taking plastic out of the ocean, but cutting through umpteen levels of bureaucracy, multiplied by 20 countries. We would spend more time negotiating with each country to get the bureaucrats to agree on levels of contribution, then on how to deal with the problem, than actually dealing with the problem.

FOR OUR CHILDREN - The children of Burgas at European Maritime Day present Alberto Laplaine Guimarães with a gift from the Bulgarian City. Sustainable growth and aims for a circular economy are for our children and their children, and their children, and their children - lest we forget why we are working to clean our act up. As trustees of planet earth we should hand the world to our successors in better shape than we found it. Copyright © photograph June 1 2018 Cleaner Ocean Foundation.

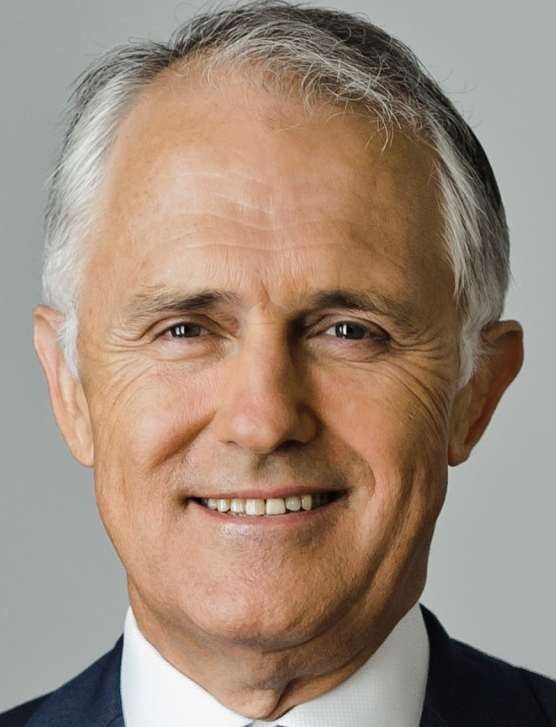

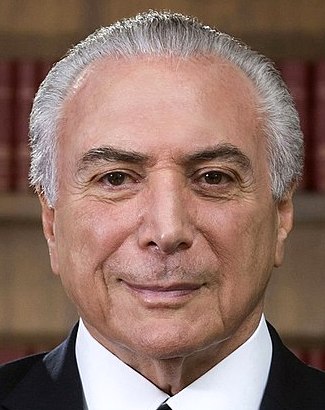

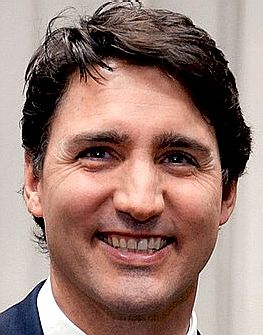

INTERNATIONAL ORGANIZATIONS 2019

THE G20 HEADS OF STATE 2019

LINKS & REFERENCE

https://www.worldbank.org/en/news/press-release/2018/10/29/seychelles-launches-worlds-first-sovereign-blue-bond https://treasury.worldbank.org/ http://www.thegef.org/ https://www.worldbank.org/en/news/feature/2018/10/29/sovereign-blue-bond-issuance-frequently-asked-questions http://www.worldbank.org/en/who-we-are

|

|||||||||||||||||||||||||||||||||||

|

This website is provided on a free basis as a public information service. Copyright © Cleaner Oceans Foundation Ltd (COFL) (Company No: 4674774) 2019. Solar Studios, BN271RF, United Kingdom. COFL is a charity without share capital.

|